Premium-Financed Life Insurance

"Borrowed capital, wisely used, can build lasting wealth."

— J. Paul Getty

High-impact protection without high upfront costs.

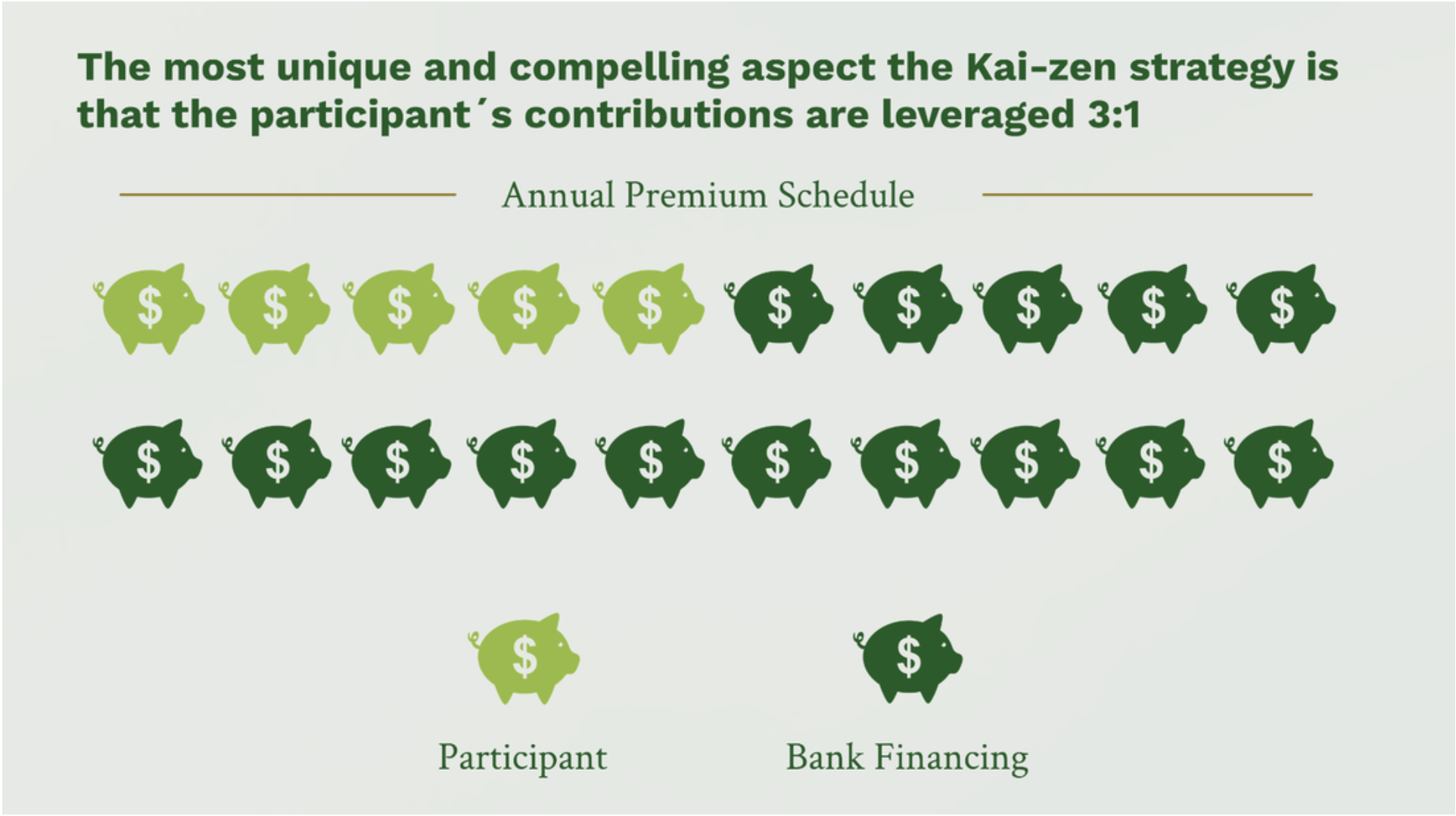

How It Leverages Capital

Premium-financed life insurance uses a third-party loan to pay for large life insurance premiums—typically on a permanent policy like IUL or whole life—so your own capital stays invested elsewhere. The policy’s cash value grows over time and may be used to repay the loan, while the death benefit remains in place. This strategy creates an efficient way to fund legacy planning, tax-free income, or estate protection without liquidating assets or disrupting investment portfolios.

Designed for High-Net-Worth Strategists

This approach is ideal for affluent individuals, entrepreneurs, and business owners with strong credit, high net worth, and long-term planning goals. It’s best for those who want to maximize life insurance benefits while maintaining liquidity and leveraging smart financial engineering to build wealth, protect estates, and create multi-generational impact—without tying up personal capital.

Continue your Exploration

Speak with an Advisor

Bridging communities, expert advisors, and leading insurers—we're the trusted connector at the center, helping you thrive with holistic financial confidence.

Corporate Office:

207 W. Millbrook Road, Suite 210

Raleigh, North Carolina 27609

(844) 626-2246

Advisor & Client

Engage

Subscribe to Our News & Articles

Get Insights Delivered right to your inbox

© Ai Merchantry®. 2026. A-32AiM, LLC. Company. All Rights Reserved.

LicenseeCheck™ | NAIC | FINRA | BrokerCheck | Privacy Policy | Terms of Use